From 1 January 2025, there will be a number of changes in liability legislation in Belgium dueto the entry into force of Book 6 of the Civil Code, which deals with extra-contractual liability.

One of the most remarkable changes is the removal of the quasi-immunity of the auxiliary person (=freelancer).

Previously, only the company they worked for could be held liable, but now the injured party can also file a claim directly against the freelancer if certain conditions are met. We asked our community partner Van Dessel Insurance Brokers to explain how this impacts freelancers in Belgium.

What Does This Mean for Freelancers?

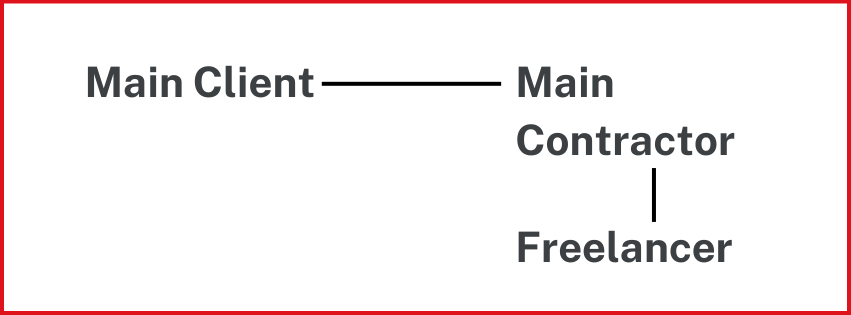

If you’re working as a freelancer under a contract between a main client (your client’s client) and a main contractor (your client), you could now be held liable for mistakes that cause damage. This is particularly relevant if your fault is considered a “mixed fault,” meaning it breaches both contractual obligations and basic rules of care. All of the below only applies in situations where you are engaged as a freelancer in the context of the performance of a contractual obligation between a client and a contractor (your client), e.g. through an agency.

If you provide services directly to your client (the company for which you work directly)

without the latter having anything to do with the performance of an obligation between the

main client and the main contractor, the general rules on liability for non-performance of an

obligation apply if you make a mistake in providing your services.

Contractual and Extra-Contractual liability Explained

The fault of the freelancer must be twofold. This is the case where the fault at the root of

the damage caused can be regarded as a breach of a contractual obligation (contractual

liability between the main client and the main contractor) on the one hand, but also as a

breach of the elementary rules of care (extra-contractual liability) that both the main

contractor and the freelancer must observe (diligence).

Example: Imagine you’re a freelancer hired by a company (let’s call them “Main Contractor”)

to help with a project for another company (the “Main Client”). If you make a mistake while

working on this project, and that mistake causes harm to the Main Client, under the new laws

starting in 2025, the Main Client could hold you directly responsible.

A “mixed fault” means your mistake violates the contract terms and basic care expectations.

For example, if you’re hired to design a website but fail to protect sensitive customer data

(basic care), and this leads to a data breach, both the Main Contractor and the Main Client

could hold you accountable.

If the fault and the damage are attributable to a freelancer engaged for the performance of

the contractual obligation, the injured party (main client) can still not bring a claim against this

freelancer on a contractual basis since there is no contract between this injured party and the

freelancer. There is only a contract between the freelancer and his client, but no contract

between the main client and the freelancer.

Protecting Yourself Through Contractual Clauses

Understanding how contracts between the main client and the main contractor can limit your

liability as a freelancer is crucial. While you may not always have control over these

agreements, knowing how they can shield you—and how to invoke defences in your

favour—is key to minimizing risk.

● First of all, the agreement between the main client and the main contractor may provide

that, if the freelancer’s liability is compromised, the main client cannot bring a claim

against this freelancer on an extra-contractual basis. And, since there is no contract

between the freelancer and the main client, no claim can be brought on a contractual

basis and in this case a certain form of liability immunity applies.

Please note: this is a contractual agreement between the main client and the main

contractor. As a freelancer, you do not always have control over this. In addition, the

wording of this clause, e.g. with regard to exceptions to its application (e.g. where there

would be a “gross misconduct” on the part of the freelancer).

● The new rules also provide that, even if the injured main client can bring a claim against

the freelancer on the basis of the rules of extra-contractual liability (for example, if the

immunity mentioned in the previous point was not provided for in the contracts), the

freelancer can still invoke all the defences that the main contractor can invoke against the

main client. For example, if the agreement between the main client and the main

contractor provides for some form of limitation of liability, the freelancer can invoke this in

his favor if he is sued directly by the injured party (main client).

● Often, a separate contract is concluded between the freelancer and the main contractor

for the services provided by the freelancer. If this agreement provides for certain means

of defence in favour of the freelancer, such as a release clause, the freelancer can invoke

these clauses, not only against the main contractor (in fact his client), but also against the

main client, if the latter addresses the freelancer directly.

Check your contracts and insurance policies

It is clear from the foregoing that much depends on the contractual arrangements that have

been or will be made in the future between the various parties involved.

● On the one hand, the agreement between the main client and the main contractor;

● On the other hand, the agreement between the main contractor and the freelancer.

These agreements will determine to what extent and under what conditions a freelancer can

be held directly liable by the main client in the future and whether the freelancer can invoke

certain means of defence such as limitations of liability in such a case.

Depending on this, it is also important for you as a freelancer to check how you are insured

for the cases in which a claim for damages is brought against you. This can be done either

through your client’s insurance policy if you are included in it as an insured person or through

a policy that you have taken out personally.

If you have not taken your own policy, we strongly recommend that you request the contract

between the client and its contractor.

However, your own insurance policy still provides the best protection. Having your own insurance policy is crucial for safeguarding your freelance business. While you may be covered under a client’s policy, this coverage might not be comprehensive or tailored to your specific needs. Your own policy ensures that you have direct control over the extent of your coverage, providing you with peace of mind in case of claims. It’s a proactive way to protect yourself against unforeseen liabilities, especially with the upcoming changes in legislation.

Exclusive Professional Liability Insurance to Freelancers in Belgium members

Van Dessel Insurance Brokers offers an exclusive Professional Liability Insurance to

Freelancers in Belgium members. To receive a confirmation of the price, please fill in page 1

and 2 and sign the document on page 4 in this form.

Send the form to tim.verlinden@vandessel.be.

He will confirm the offer within two working days and can

answer more questions if needed. See more on Freelancers in Belgium Partner Offers.